extend more generous payment terms to their customers as a competitive advantage.take advantage of supplier or vendor fast pay (or cash) discounts.Organizations that factor invoices expedite cash flow, which means they have more flexibility to: Instead of waiting on customer payments, you can factor a customer invoice on the same day it’s generated and receive and advance of up to 90 percent of the face amount of the invoice right away.įactoring receivables enables you to focus on growing your business rather than chasing invoices or performing collections. You can gain immediate access to working capital by speeding up cash flow, so that you can reinvest in your company much more quickly.įactoring receivables could also be the key to positioning your business to be able to take advantage of emerging opportunities. What are the benefits of invoice factoring? Your company receives the $600 reserve amount after the invoice is paid The factoring company earns 5% factoring fee of $600 Your company receives 90% advance of $10,800 by wire transfer or ACH Generate $12,000 client invoice and factor it Invoices factored may be funded as soon as 0-2 business days – up to 90% of the face value of the invoice, with the remainder placed in ‘reserve.’ For instance, let’s say that you are billing a customer in the amount of $12,000 but you want to access the funds without waiting weeks – or months – for your customer to pay.Īssuming a factoring fee of 5%, and an advance rate of 90%, here’s how it would work: Day 1 – How does the invoice factoring process work?Īn invoice factoring calculator shows the amount of working capital an organization could expedite in order to more easily meet operating expenses and grow.īusinesses that want to expedite payment of accounts receivable invoices can factor them (or sell them) to a receivables factoring company for a small fee (called a factoring fee). In essence, anything an organization could do if it had the money tied up in customer invoices on hand, instead of on the books, are the opportunity cost to the organization of not factoring invoices. Inadequate cash flow for payroll or operating expenses.Inability to take advantage of vendor cash or quick-pay discounts.Inability to take on new business, serve large customers or fill big orders.These types of opportunities lost due to slow cash flow could come in many forms:

Any opportunity that an organization cannot take advantage of while waiting on this working capital are the opportunities “lost” to the business. It’s commonly referred to as an opportunity cost calculator.

#Factoring calculator how to#

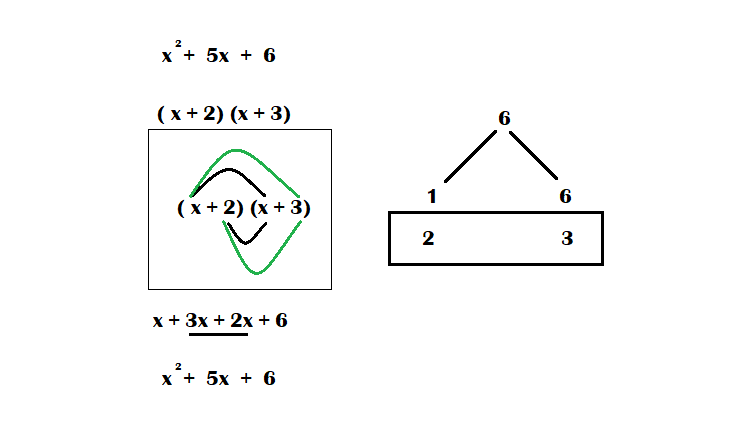

Please let us know if you have any suggestions on how to make Factoring Calculator better.An invoice factoring calculator (also known as an opportunity cost calculator) reveals the amount of working capital currently tied up in an organization’s accounts receivable invoices that could be available to the organization immediately if they factored the invoices instead of waiting on customer payments. Factoring Calculator is also used for computing equation divisibility and finding the lowest common denominator and greatest common divisor of two equations. if equation is f(x)=0 and f(x) could be factored out into f(x)=g(x)*h(x) then solutions of g(x)=0 and h(x)=0 are also solutions of f(x)=0. Factoring Calculator can be used during the first step of solving an equation. To factor integer numbers please use number factorizer. It can factor an expressions with polynomials involving any number of variables as well as more complex function. Factoring calculator transforms a complex expression into a product of simpler factors.

0 kommentar(er)

0 kommentar(er)